America’s trusted partner in debt relief and credit education

At Debt Rest, we offer transparent support, personalized plans, and practical tools to help everyday Americans break free from debt — for good.

Or call 800-555-1234 for immediate support.

What Makes Debt Rest Different?

We're more than a service — we're a movement to help Americans reclaim financial peace. No gimmicks, no pressure. Just honest help.

People First

We treat you with empathy, not judgment. Every situation is unique, and so is our plan for you.

Transparent Support

You’ll understand every step. No hidden fees. No fine print. Just a clear path to freedom from debt.

Certified & Trusted

We're backed by leading industry standards. We do things by the book, for your protection and peace of mind.

From Stress to Success

"I thought bankruptcy was my only option... but Debt Rest helped me cut my monthly payments in half and finally breathe again." — Michelle T., Florida

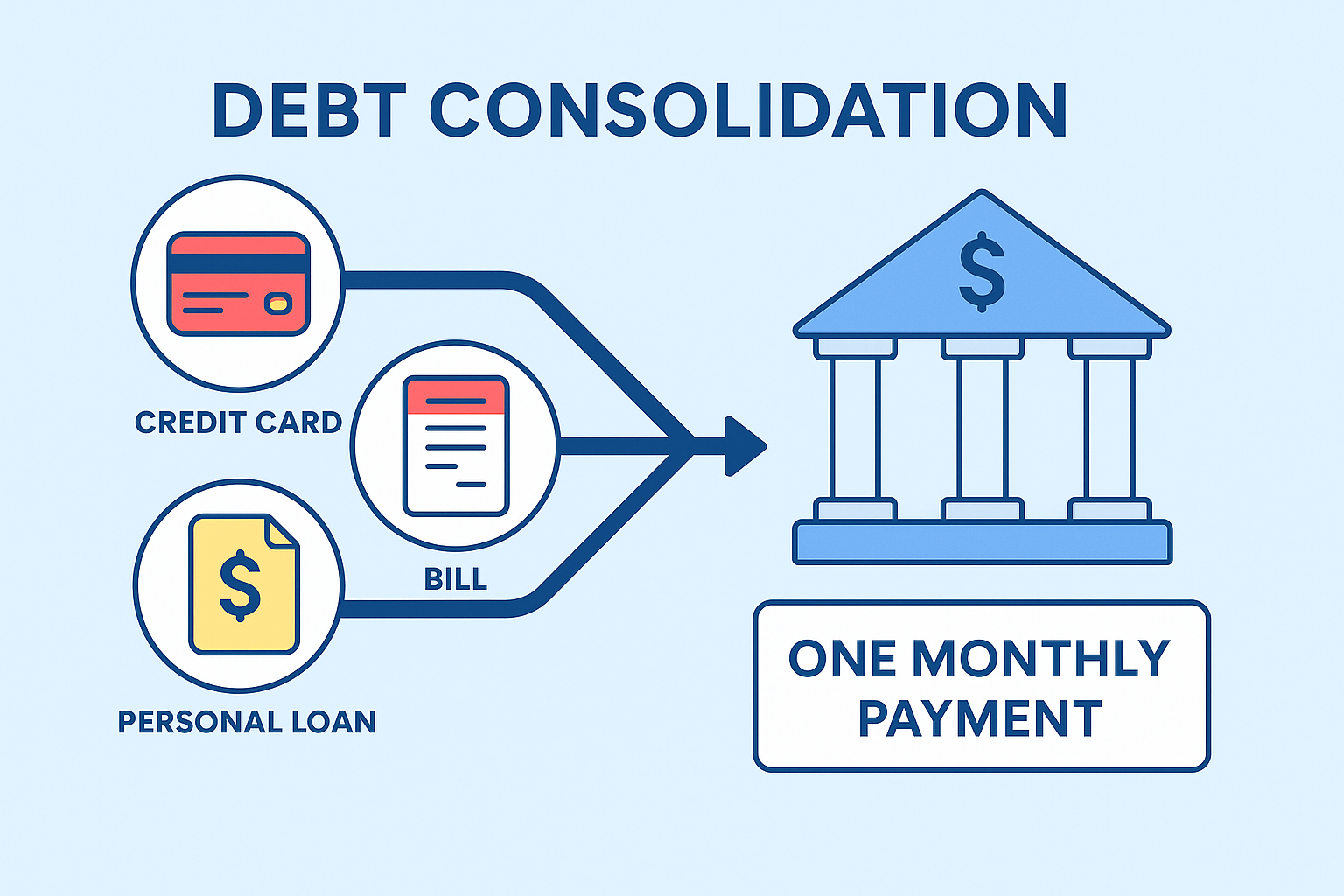

See If You QualifyHow It Works — Simple, Stress-Free, Proven

1. Talk to a Counselor

We'll get to know your situation and goals. No judgment. Just a real person who cares.

2. Build a Custom Plan

Based on your income and debt, we’ll create a realistic path — tailored to your life.

3. Start Saving & Resetting

We’ll negotiate with creditors, lower payments, and help you get ahead month after month.

Real People. Real Results.

"We were paying over $600/month across 5 cards. Now we’re down to $250 and finally making progress."

— James & Marissa, TX

"I was skeptical, but they helped me eliminate $30K in debt — no loans, no judgment, no stress."

— Robyn G., CA

"They treated me with respect. No confusing terms — just clear steps and real savings."

— Amanda T., FL

FAQs — Your Questions Answered

You Can Count On Us