Not Sure If You Qualify?

We help everyday people overwhelmed by debt—those with good jobs, big goals, and real financial stress. If that sounds like you, you're in the right place.

Tired of Drowning in Credit Card Debt?

If you're 28+ with steady income and over $15,000 in credit card debt, we help cut your payments — without loans, without bankruptcy, and without judgment.

See If You QualifyWe’ve helped people in all kinds of situations

Sarah, 34 – Single Mum

Juggling childcare and a full-time job, Sarah was using credit cards to stay afloat. We helped her lower her payments and finally build savings.

Jason & Mia, 40s – Homeowners

After years of minimum payments and rising rates, they needed real relief. Debt Rest helped them cut their monthly payments in half.

Derek, 29 – Career Starter

With $28K in credit debt and a new job, Derek couldn’t see a way out. We gave him a plan that fit his budget and goals.

Real People. Real Results.

"We were paying over $600/month across 5 cards. Now we’re down to $250 and finally making progress."

— James & Marissa, TX

"I was skeptical, but they helped me eliminate $30K in debt — no loans, no judgment, no stress."

— Robyn G., CA

"They treated me with respect. No confusing terms — just clear steps and real savings."

— Amanda T., FL

How It Works

Step 1

Fill out our short quiz (takes < 1 min) — no credit impact.

Step 2

We review your debt & build a personalized plan.

Step 3

You approve the plan and make just one payment.

Step 4

Watch your debt shrink — and your stress go with it.

We’ll Walk You Through All of Your Options

Whatever your income or financial situation, we have counselors ready to help you build a personalized action plan — with the right resources for your unique journey.

Debt Management Plan

Reduce interest rates and combine all payments into one simple monthly plan — no new loan required.

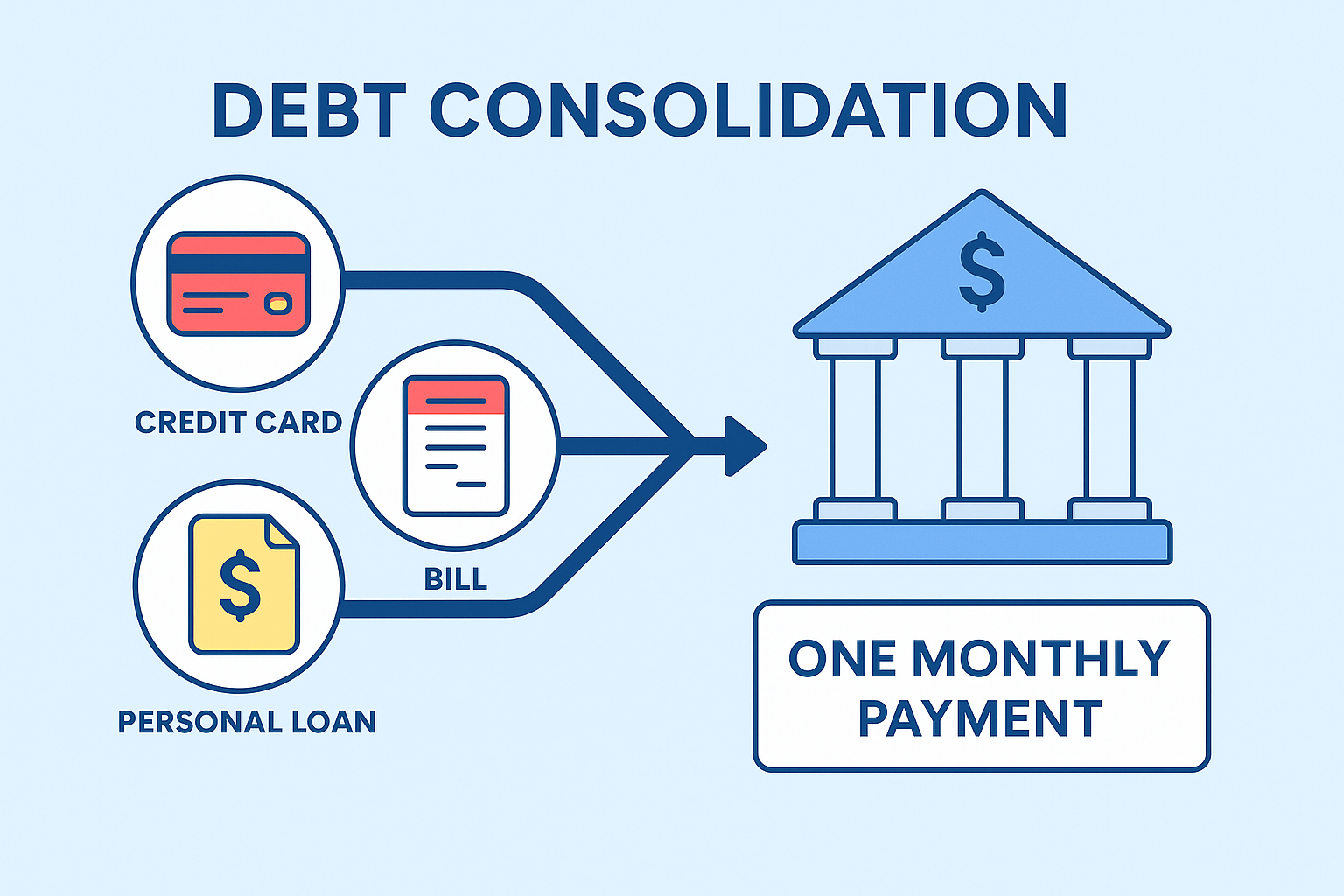

Debt Consolidation

Combine multiple debts into one — with the possibility of lower interest, better terms, and easier budgeting.

Bankruptcy

In some cases, starting fresh is the right path — we'll explain the pros and cons without pressure or judgment.

FAQs — Your Questions Answered

You Can Count On Us